Joint Debt Consolidation Loans offer UK individuals a collaborative solution to manage multiple debts, combining balances into a single loan with potentially reduced interest costs. Secured loans utilize collateral like property, providing lower rates but risk of asset loss upon missed payments. Unsecured options are flexible and low-risk but have higher interest rates. A hybrid approach combines both secured and unsecured loans, tailored to diverse financial needs, offering larger amounts and manageable repayment strategies based on individual situations and credit profiles. Key keywords: Joint Debt Consolidation Loans

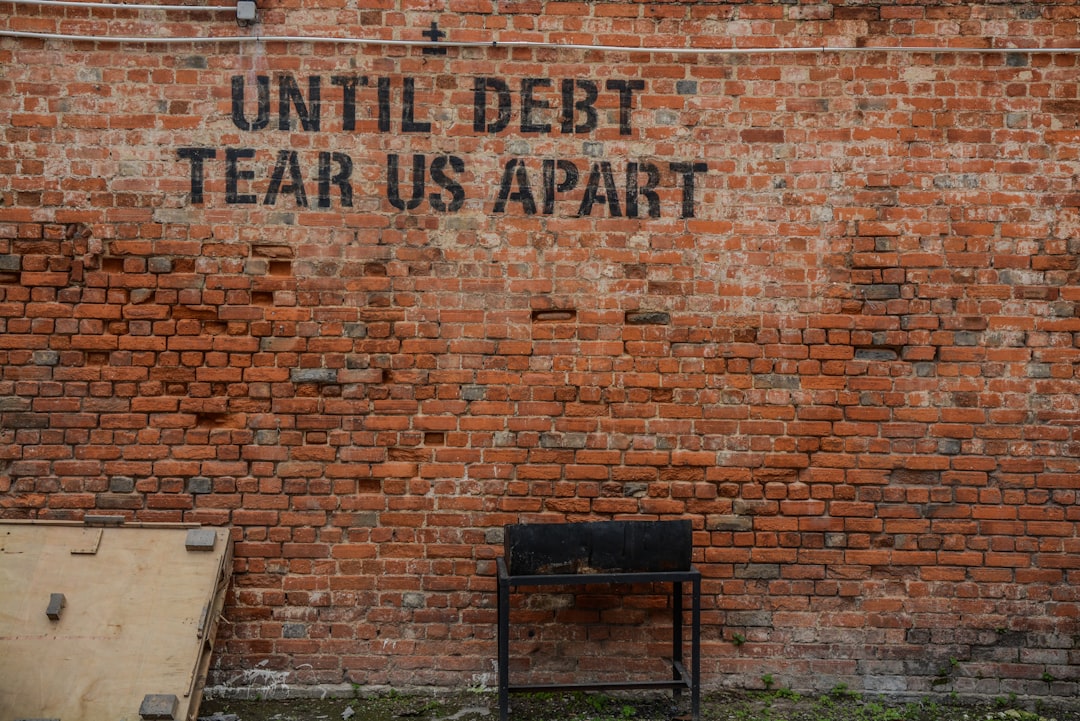

In today’s financial landscape, managing multiple debts can be a daunting task. For UK residents seeking relief, Joint Debt Consolidation Loans offer a potential solution. This comprehensive guide explores the various types available, from secured to unsecured, and their unique benefits. We delve into how these loans can simplify repayment, reduce interest rates, and provide a clear financial path. Whether traditional or flexible, understanding your options is key to making informed decisions for a brighter financial future.

- Understanding Debt Consolidation Loans: A Comprehensive Overview

- Secured Loans: The Traditional Approach to Debt Consolidation

- Unsecured Loans: A Flexible Option for Debt Relief

- Combining Secured and Unsecured Loans: Finding the Best Balance

Understanding Debt Consolidation Loans: A Comprehensive Overview

Debt consolidation loans are a popular financial solution for many individuals struggling with multiple debts in the UK. These loans allow borrowers to combine several outstanding debts into a single loan, simplifying repayment and potentially reducing overall interest costs. The process involves taking out a new loan with a lower interest rate than the existing debts, thereby consolidating them into one manageable payment.

Joint Debt Consolidation Loans specifically cater to individuals who have multiple debts but want to maintain a collaborative approach to financial management. This type of loan allows two or more people to jointly apply and take responsibility for repaying the debt together. It’s an ideal solution for couples or family members who wish to pool their resources to tackle shared debt obligations, offering both convenience and potential savings in interest charges.

Secured Loans: The Traditional Approach to Debt Consolidation

Secured loans have long been the traditional method for individuals seeking debt consolidation in the UK. This approach involves using an asset, typically a property or vehicle, as collateral to secure the loan. The appeal lies in often lower interest rates and more favourable terms compared to unsecured options. Lenders are more willing to offer larger borrowing amounts with secured loans, making them suitable for those carrying substantial joint debt.

By harnessing an asset’s value, borrowers can consolidate multiple debts into one manageable repayment. This simplicity can be a significant advantage, streamlining financial obligations and potentially saving on interest charges over the long term. However, it’s crucial to remember that failure to repay could result in the loss of the collateralized asset, underscoring the importance of careful consideration and assessment before opting for this type of debt consolidation loan.

Unsecured Loans: A Flexible Option for Debt Relief

Unsecured loans offer a flexible option for those seeking debt relief, particularly in the UK. Unlike secured loans, which require borrowers to put up an asset as collateral, unsecured loans don’t carry this risk. This makes them an attractive choice for individuals looking to consolidate their debts without tying up valuable assets. Joint Debt Consolidation Loans, for instance, allow two or more people to borrow funds together, potentially increasing the loan amount and improving individual credit scores through consistent repayments.

This type of loan is ideal for managing multiple debts, as it can simplify repayment processes by combining several smaller debts into one larger, often lower-interest loan. This flexibility can be particularly beneficial for UK residents dealing with high-interest credit card debt or personal loans, providing a clearer financial path towards debt-free living.

Combining Secured and Unsecured Loans: Finding the Best Balance

Combining secured and unsecured loans can offer a balanced approach to debt consolidation, catering to various financial needs. Secured loans use an asset as collateral, often property or vehicles, providing lenders with security and potentially lower interest rates. Unsecured loans, on the other hand, don’t require collateral but typically carry higher interest rates due to the increased risk for lenders.

When considering a joint debt consolidation loan that blends both secured and unsecured options, borrowers can leverage the advantages of each. This hybrid approach allows for accessing larger loan amounts (secured portion) while benefitting from more flexible repayment terms (unsecured part). It’s crucial to evaluate individual financial situations and credit profiles to determine the optimal mix, ensuring a manageable debt repayment strategy without overextending resources.

When considering debt consolidation, whether through secured, unsecured, or a combination of both loans in the UK, understanding your financial situation and goals is key. Secured loans offer stability but require collateral, while unsecured loans provide flexibility without it. Combining these options can create a tailored solution for effective joint debt consolidation. By exploring the pros and cons of each approach, individuals can make informed decisions to achieve financial freedom and break free from debt once and for all.