Joint Debt Consolidation Loans streamline multiple debts into one manageable loan for homeowners, simplifying repayment, freeing up cash flow, and reducing interest costs. Ideal for home improvements, these loans require both borrowers to meet specific criteria like strong credit scores and sufficient property equity. They offer fixed or variable interest rates and encourage teamwork between homeowners. Success stories show how these loans transform spaces, but risks exist; missed payments or dropping home values can lead to foreclosure. Alternatives like savings or personal loans may be better suited for certain situations.

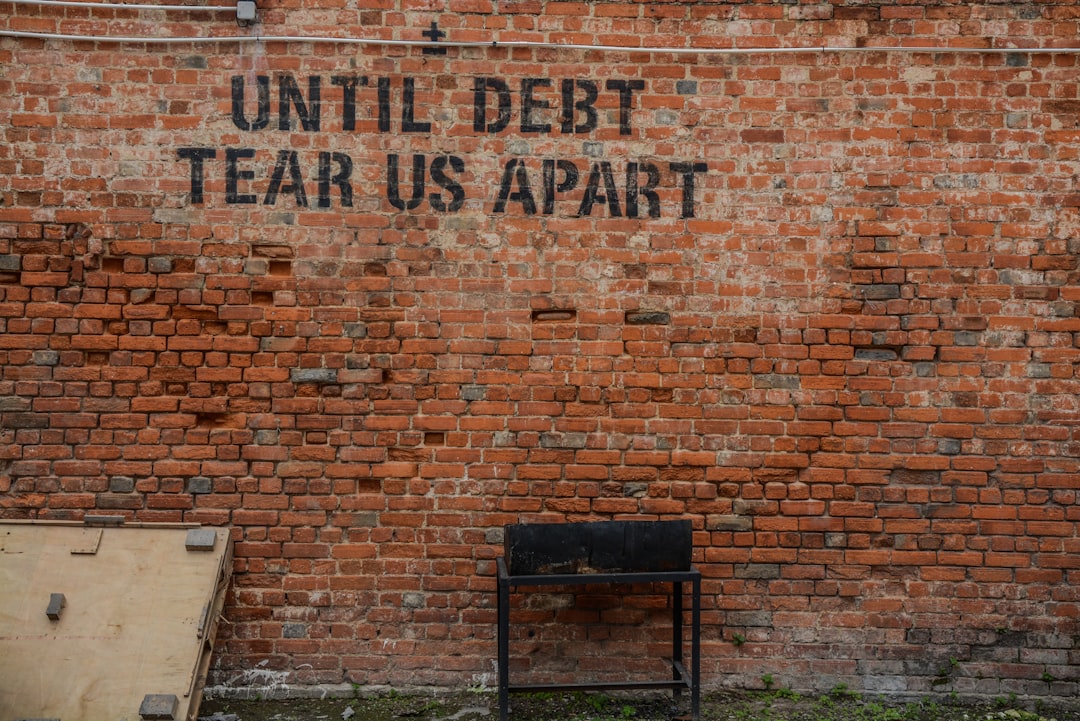

Looking to transform your home but burdened by debt? Joint Debt Consolidation Loans might be the key to unlocking both financial freedom and your dream renovation. This comprehensive guide explores how these loans can fund home improvements, offering a practical solution for savvy homeowners. We’ll delve into the benefits, qualification criteria, repayment options, real-life success stories, and potential risks, providing insights on making informed decisions about your next home project.

- Understanding Joint Debt Consolidation Loans

- Benefits of Using for Home Improvements

- How to Qualify for These Loans

- Repayment Options and Considerations

- Successful Renovation Stories

- Risks and When to Avoid This Method

Understanding Joint Debt Consolidation Loans

Joint Debt Consolidation Loans are a strategic financial tool that allows homeowners to combine multiple debts into a single, more manageable loan. This approach is particularly beneficial when considering home improvements or renovations, as it simplifies repayment and can free up cash flow. By consolidating debts, homeowners can avoid the hassle of making several monthly payments and reduce the overall interest they pay over time.

These loans are designed to be a collaborative effort between multiple debtors, often spouses or family members, who share equal responsibility for the loan’s repayment. This shared obligation ensures that there is accountability and a combined commitment to managing the debt effectively. With a Joint Debt Consolidation Loan, funds can be used for various home improvement projects, from kitchen renovations to energy-efficient upgrades, providing homeowners with the financial flexibility to create their dream living spaces.

Benefits of Using for Home Improvements

Using a Joint Debt Consolidation Loan for home improvements can simplify your financial situation and make your renovation dreams a reality. These loans offer several benefits tailored to homeowners looking to enhance their living spaces. Firstly, they provide a clear repayment plan with fixed interest rates, eliminating the hassle of multiple loan payments scattered across various lenders. This consolidation streamlines the repayment process, making it easier to budget and manage your finances during the improvement project.

Additionally, Joint Debt Consolidation Loans often offer lower interest rates compared to traditional renovation loans or credit cards. By consolidating existing debts, you can free up extra cash flow that would otherwise go towards interest payments, allowing you to allocate more funds for home improvements. This strategic approach not only enhances your living environment but also saves money in the long run by reducing overall debt and interest expenses.

How to Qualify for These Loans

To qualify for Joint Debt Consolidation Loans, which can fund home improvements or renovations, both borrowers must meet specific criteria. Lenders will consider your credit history, income, and existing debt obligations. A strong credit score and stable employment history are typically required. It’s also important to demonstrate that you have sufficient equity in your property, as these loans often require a down payment or home equity as collateral.

The loan amount is determined based on the value of your home and the outstanding balance of your current mortgage. Lenders will assess your financial situation to ensure that the new debt, including the consolidation loan, aligns with your ability to make repayments without causing financial strain. Understanding these requirements beforehand can help streamline the application process.

Repayment Options and Considerations

When considering a debt consolidation mortgage for home improvements, it’s crucial to understand your repayment options. These loans are designed to bundle multiple debts into one manageable payment, simplifying financial management. You can choose between fixed-rate or variable-interest plans, each offering distinct advantages and considerations. Fixed rates provide stability with predictable monthly payments over the loan term, while variable rates fluctuate based on market conditions, potentially resulting in lower long-term costs if interest rates decline.

Additionally, joint debt consolidation loans offer a collaborative approach where both homeowners are responsible for repayment. This shared obligation can be beneficial for couples, fostering teamwork in managing finances and ensuring timely payments. However, it’s essential to maintain open communication and mutually agreed-upon financial goals to navigate potential challenges together throughout the loan period.

Successful Renovation Stories

Many homeowners are turning to debt consolidation mortgages, specifically joint debt consolidation loans, to fund their dream home renovations. These stories of success showcase how this strategy can transform outdated spaces into modern, functional areas that enhance overall living experiences. For instance, consider a couple who, with the help of a joint debt consolidation loan, were able to renovate their 1950s kitchen and bathroom. They transformed these once cramped and outdated spaces into open-concept, stylish areas complete with new appliances and modern fixtures.

Another inspiring tale is that of a single parent who, by consolidating their debts through a mortgage loan, was able to afford a complete renovation of their child’s bedroom and play area. The result was a bright, inviting space tailored to the child’s needs and interests, significantly improving both their quality of life and family dynamics. These examples demonstrate how access to funding through joint debt consolidation loans can make home improvements more achievable for many families.

Risks and When to Avoid This Method

While debt consolidation mortgages can be a viable option for funding home improvements, there are risks to consider. These loans bundle multiple debts into a single repayment with a potentially lower interest rate, but they tie your equity to the loan. If you default on payments, it could lead to foreclosure, especially if your home values decline or your income fluctuates. Joint debt consolidation loans can be particularly risky for couples, as both are responsible for repaying the debt.

This method might not be suitable when planning significant renovations that require substantial upfront costs or if you have a history of missed payments. It’s generally advisable to explore other financing options, such as savings, personal loans, or home equity lines of credit, if these alternatives align better with your financial situation and goals.

Joint Debt Consolidation Loans can be a powerful tool for funding home improvements, offering streamlined repayment and potentially lower interest rates. By consolidating multiple debts into one manageable loan, homeowners can free up cash flow to invest in much-needed renovations. However, it’s essential to carefully consider the repayment terms and assess if this approach aligns with your financial goals and risk tolerance. Weighing the benefits against the risks will help you make an informed decision when using Joint Debt Consolidation Loans for home improvement projects.