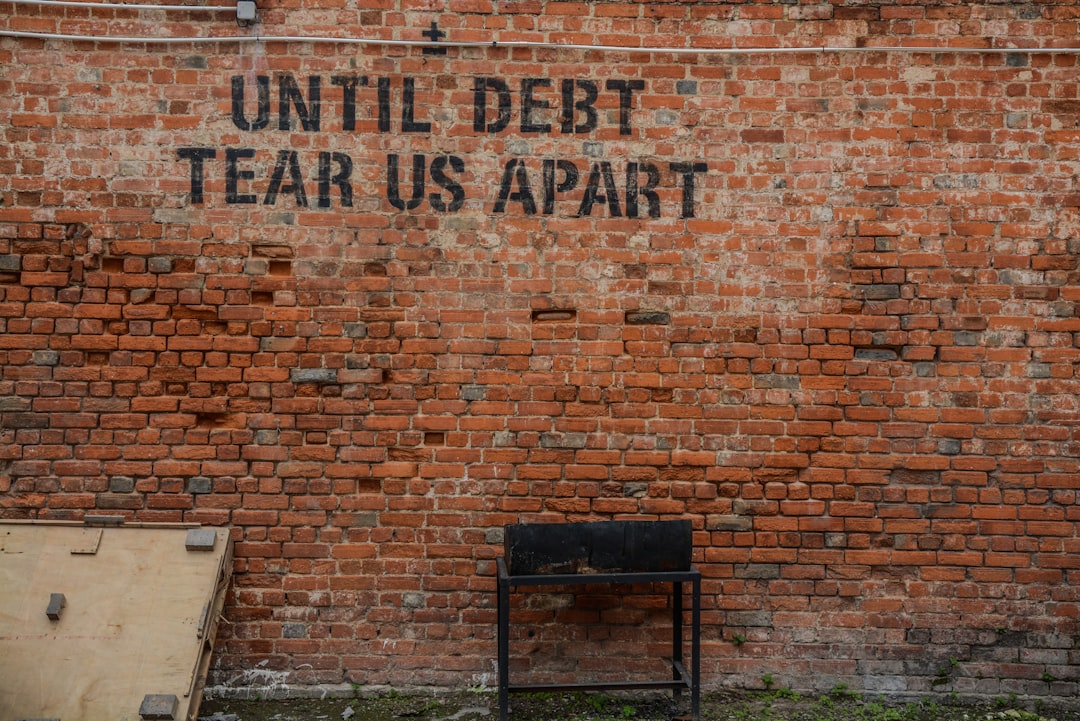

Married couples facing multiple debts can transform their financial landscape with Joint Debt Consolidation Loans. By pooling resources and assuming joint responsibility, these loans simplify repayment, reduce interest rates, and strengthen the couple's financial partnership. The application process involves sharing financial details and combined income, leading to unified debt management with potentially lower rates. Strategic repayment strategies, open communication, and shared goals are key to building a solid financial foundation and accelerating progress towards financial freedom.

Many married couples face financial challenges with a single income. Joint Debt Consolidation Loans offer a strategic solution by combining multiple debts into one, manageable payment. This article explores how these loans can alleviate financial stress and strengthen partnerships through shared responsibility. We’ll break down the process, benefits, and essential strategies for successful repayment, empowering couples to navigate their finances together. Learn about the power of Joint Debt Consolidation Loans in simplifying debt and fostering a healthier financial future.

- Understanding Joint Debt Consolidation Loans

- Benefits of Combined Financial Responsibility

- The Process: Applying for a Joint Loan

- Strategies to Repay and Maintain a Healthy Financial Partnership

Understanding Joint Debt Consolidation Loans

Married couples facing debt challenges often look for effective solutions to streamline their financial obligations. One powerful tool they can utilize is a Joint Debt Consolidation Loan. This type of loan involves both spouses assuming joint responsibility for repaying a single, consolidated debt. By bundling multiple debts into one, couples can simplify their repayment process and potentially reduce the overall interest rates.

Understanding this concept is crucial when navigating financial options as a married couple. Joint loans provide an opportunity to gain control over debts, making it easier to manage and ultimately pay off outstanding balances faster. It’s a strategic move that requires trust and collaboration, ensuring both partners are committed to the shared goal of financial freedom.

Benefits of Combined Financial Responsibility

When married couples decide to take out a Joint Debt Consolidation Loan, they’re not just pooling their resources financially; they’re also sharing a significant responsibility. This combined financial effort offers several advantages. For one, it allows them to tackle multiple debts with a single, more manageable payment, simplifying their budgeting and potentially saving them money in interest charges.

Additionally, this shared responsibility strengthens their financial partnership. Both partners are equally invested in repaying the loan, which can lead to better communication about spending habits and future financial goals. This collaborative approach can foster a healthier relationship with money, enabling the couple to make more informed decisions together.

The Process: Applying for a Joint Loan

When it comes to applying for a Joint Debt Consolidation Loan, married couples take a collaborative approach to managing their finances. Both partners are required to be involved in the application process, providing their financial information and credit history. This includes verifying income, assets, and any existing debts. Lenders assess the couple’s overall financial health and stability, considering their combined earnings and ability to repay.

The application typically involves filling out a joint loan application form, where both spouses detail their personal information, employment status, and debt obligations. Lenders may also request additional documents, such as tax returns or bank statements, to gain a comprehensive view of the couple’s financial standing. Once approved, the Joint Debt Consolidation Loan funds are usually disbursed to both partners jointly, enabling them to manage multiple debts under one loan with potentially lower interest rates and unified repayment terms.

Strategies to Repay and Maintain a Healthy Financial Partnership

When couples take on joint debt consolidation loans, effective repayment strategies are key to maintaining a healthy financial partnership. Firstly, open communication is vital; both partners should understand the loan terms and share responsibility for repayments. Creating a realistic budget that accounts for all expenses and leaves room for savings can help ensure timely payments.

Regularly reviewing the loan progress together, setting short-term and long-term goals, and celebrating milestones achieved can foster a collaborative environment. Additionally, prioritizing high-interest debts first and avoiding new credit inquiries or unnecessary spending will expedite repayment and reduce overall costs, strengthening the couple’s financial bond.

Married couples facing debt can find solace in Joint Debt Consolidation Loans, offering a streamlined path to financial stability. By pooling resources and taking on a shared responsibility, these loans provide an efficient strategy to manage multiple debts. Through a structured repayment plan, couples can achieve their financial goals and maintain a healthy monetary partnership. Embracing this approach allows them to focus on growing together, free from the burden of individual debt management.